P/E, EV/EBIT, P/FCF, what are the best multiples to use when we value a company?

Why is the financial world enamored with the P/E multiple and the earnings per share?

Why are a lot of management incentives related to a future EPS number?

In this post, we’ll discuss why it’s important to be careful when using the P/E ratio, and if there are better multiples you could use.

We’ve written about what is behind the P/E multiple in the past:

Basic definitions

When a business recognizes revenue and subtracts all its expenses, we arrive at earnings. These earnings can be retained and reinvested in the company.

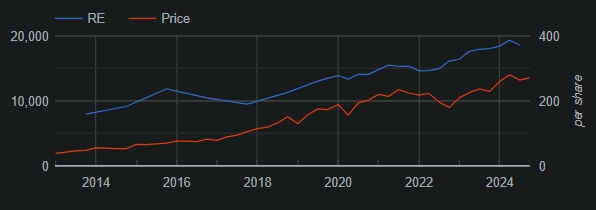

Retained earnings is a number that is not often discussed, but it gives us a glimpse of what the company has done with the earnings over the past years.

For some companies, it’s striking how much the profile of retained earnings matches the price of the stock in the market.

Take Visa for example:

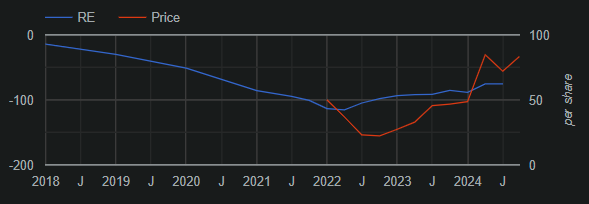

Other companies, while still loss-making, are starting to turn the tide:

Haypp: A Swedish nicotine pouches producer

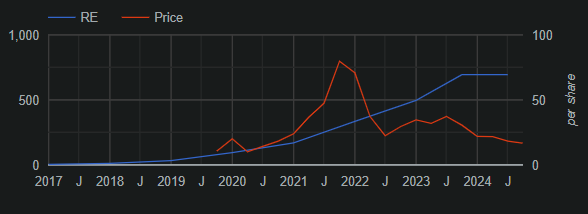

Or growth in earnings suddenly stalls at Inmode:

However, to most managers, retained earnings are considered free money. As an investor, you need to take into account your opportunity cost.

In any case, earnings can be manipulated. Stephen Clapham from

has written a whole book on it.Diving deeper into forensic accounting is interesting for a future post. I think it’s important you can detect a red flag; especially if you’re hunting into the smaller companies.

But if earnings are unreliable, why does almost everyone use the P/E ratio?

Because it’s easy. Let’s see how to make it better.

Improvements for the P/E

A first improvement on the P/E multiple is to include 2 things.

First, the capital structure (cash and debt) into the ratio using the enterprise value.

Think like a private business owner. You want to pay for the actual value of the business.

EV = Market Cap - CASH + DEBT

Let’s say companies A and B both have a market cap of 100M. But company B has 50M in cash.. Let’s say both earn 10M per year.

Both companies have a P/E of 10. But company A has an EV/E of 10 and company B has an EV/E of 5 It’s obvious, all else being equal which would be the better pick.

Now let’s tackle the denominator. Again the financial structure infers interest income or payments. You want to assess the earnings from operations generated by the business. So instead of using earnings, you can use EBIT.

EV/EBIT is a popular metric. According to the multi-bagger study from Dede Eyesan, to be able to nail a multi-bagger, the EV/EBIT should not be higher than 10. You can find the report on his 10-bagger study here.

But is it perfect?

No. One of the big things it lacks is it does not compensate for the capital needed to maintain and grow the business.

In comes the free cash flow. By subtracting the cash needed to maintain and grow the company from the operating cash flow, we get the free cash flow. The cash that is available for shareholders.

The multiple then becomes EV/FCF

EV/FCF

Inmode = 5

Visa = 29

Tesla = 400

Paypal = 11

Stellantis := 8

But that’s just a photo of the current pricing in the market. (Visa is by far the best business on this list. )

Is there a One Ring?

As with everything in investing and finance, is there a ‘best’ multiple?

Although I prefer EV/EBIT, I’m going to give you the same lame answer that is often given: “It depends’.

It depends on where the company is in its life cycle.

We discussed the life cycle of the company before. The previous multiples can only be used based on what the company is generating.

If it has no earnings, then you cannot use P/E

If it has no operating earnings, then you cannot use EV/EBIT

If it has no revenue, well, you may want to stay away from there 🙂

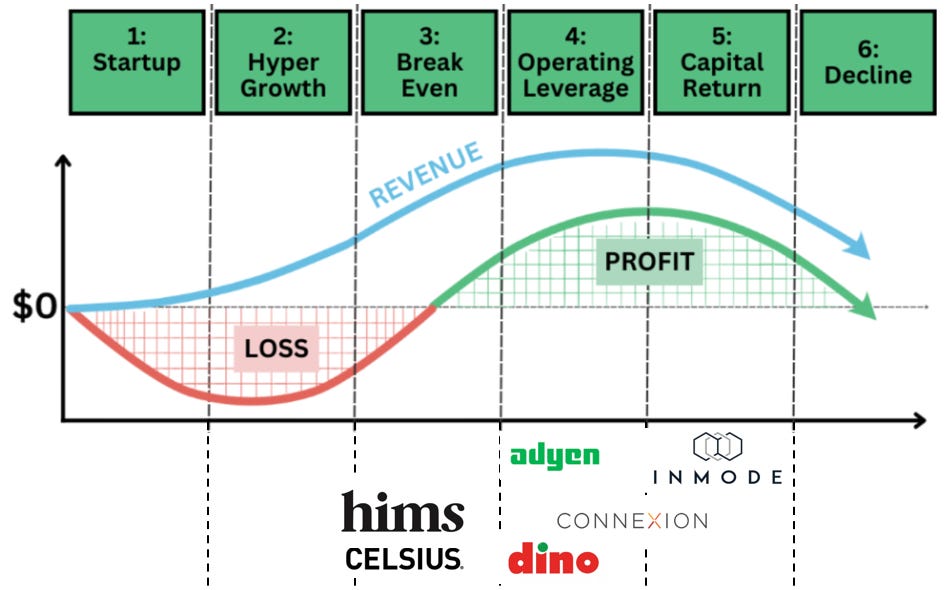

Let’s take a look at some companies we’ve previously covered and put them on the life cycle of a typical company:

I want to emphasize that 1 business can have multiple business models and lines. And a new business line can have an impact on where the business resides in its lifecycle. In other words, a business may jump around the lifecycle.

As a startup, grows into a mature business, and develops a new business line. The old business line shrinks, the new one grows rapidly, and the overall business jumps from phase 4 or 5 back to phases 2 or 3. The arrow or time destination in the life cycle can be misleading.

When you look at the picture, you’ll see that I haven’t always located every business in the center of a phase. They usually sit somewhere in between.

What does this mean for the use of the correct multiple? Let’s expand the image.

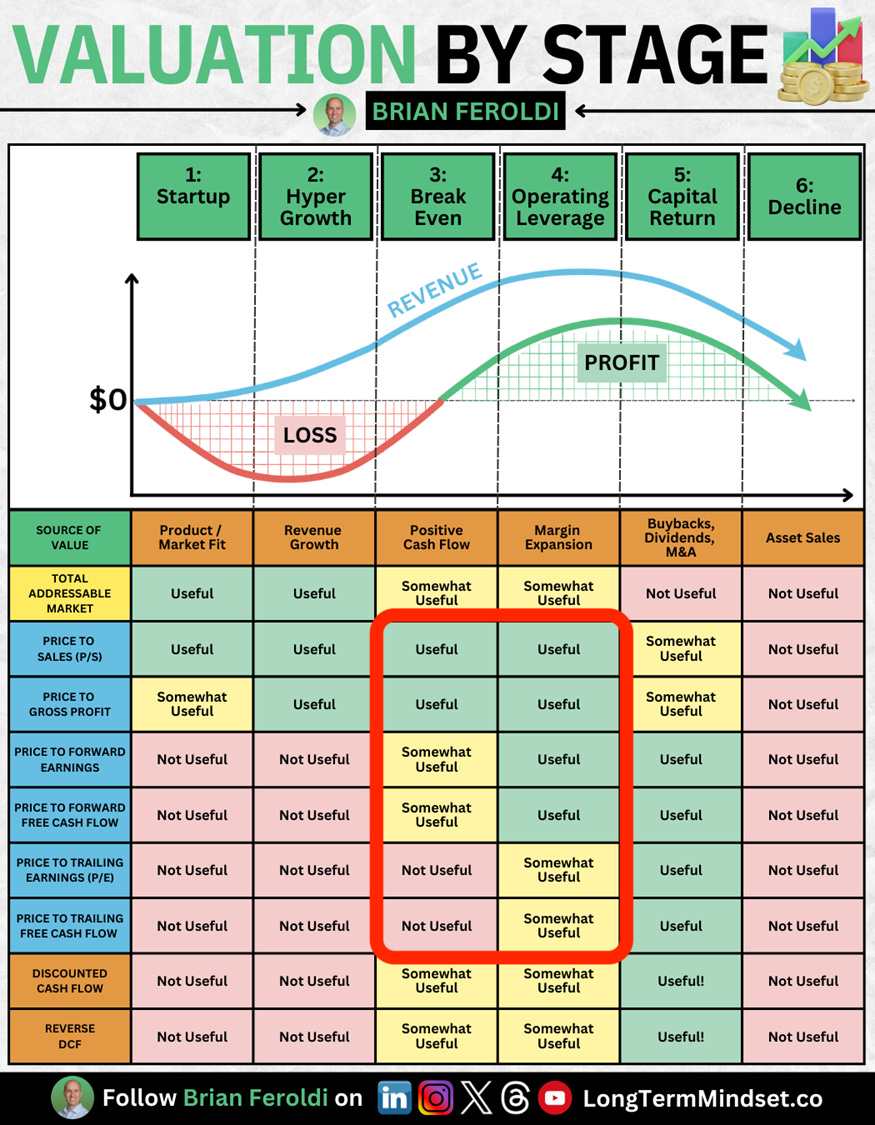

We’re using a great graphic made by Brian Feroldi at

:Let’s use this and apply the appropriate multiples to the following companies:

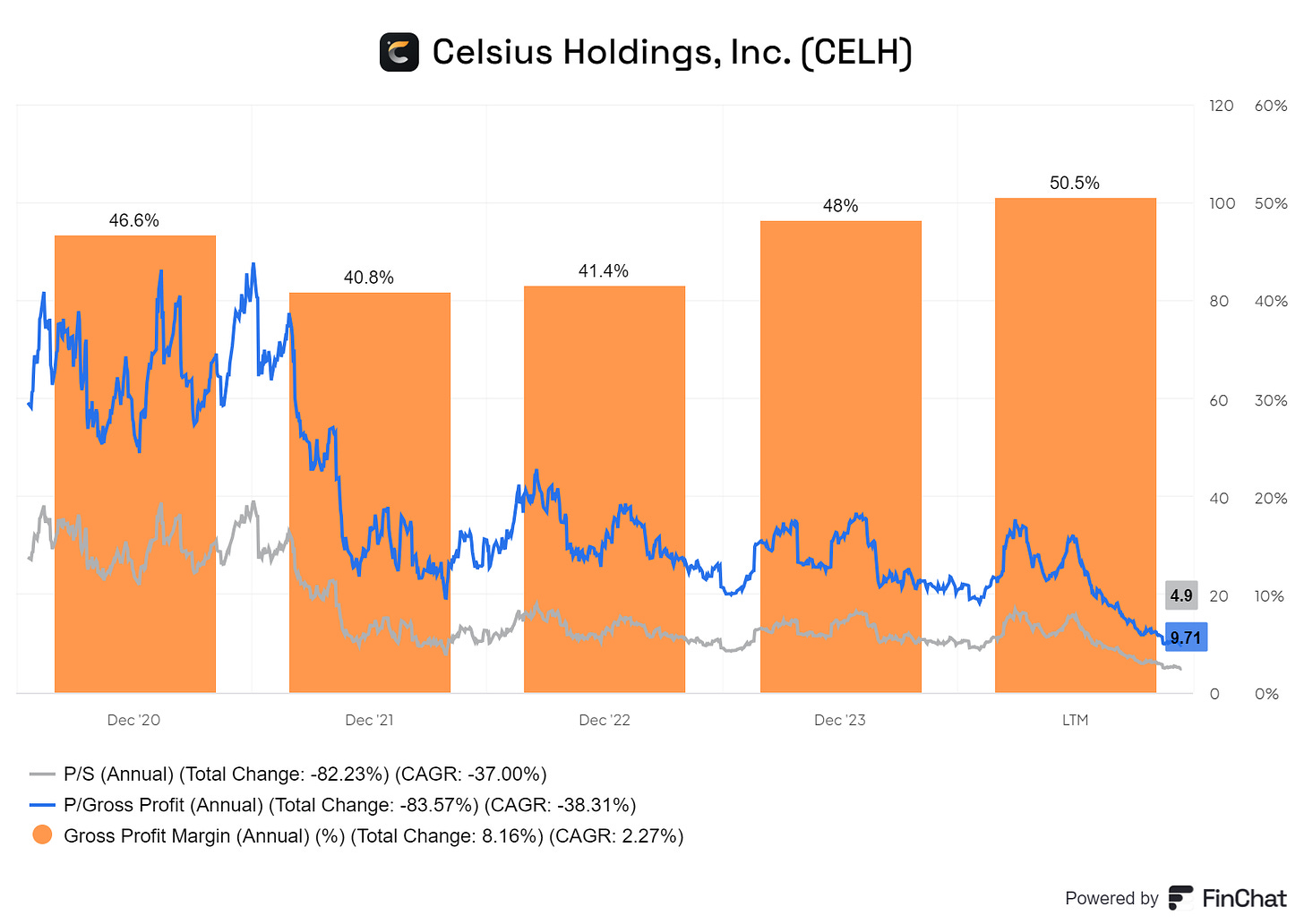

Celsius, the next Monster? ($CELH)

I do not know Celsius that well, but I wanted to add it as a contrast to the more mature companies on the list.

Gross margins have slightly increased. The price-to-sales ratio and price-to-gross profits have therefore been similar.

You’re probably asking, is Celsius undervalued given the selling pressure it is under? Based on these pricing multiples, it’s back at the 2020 levels.

However, I do not know the company sufficiently to judge its intrinsic value. And you need some judgment of that to decide on valuation.

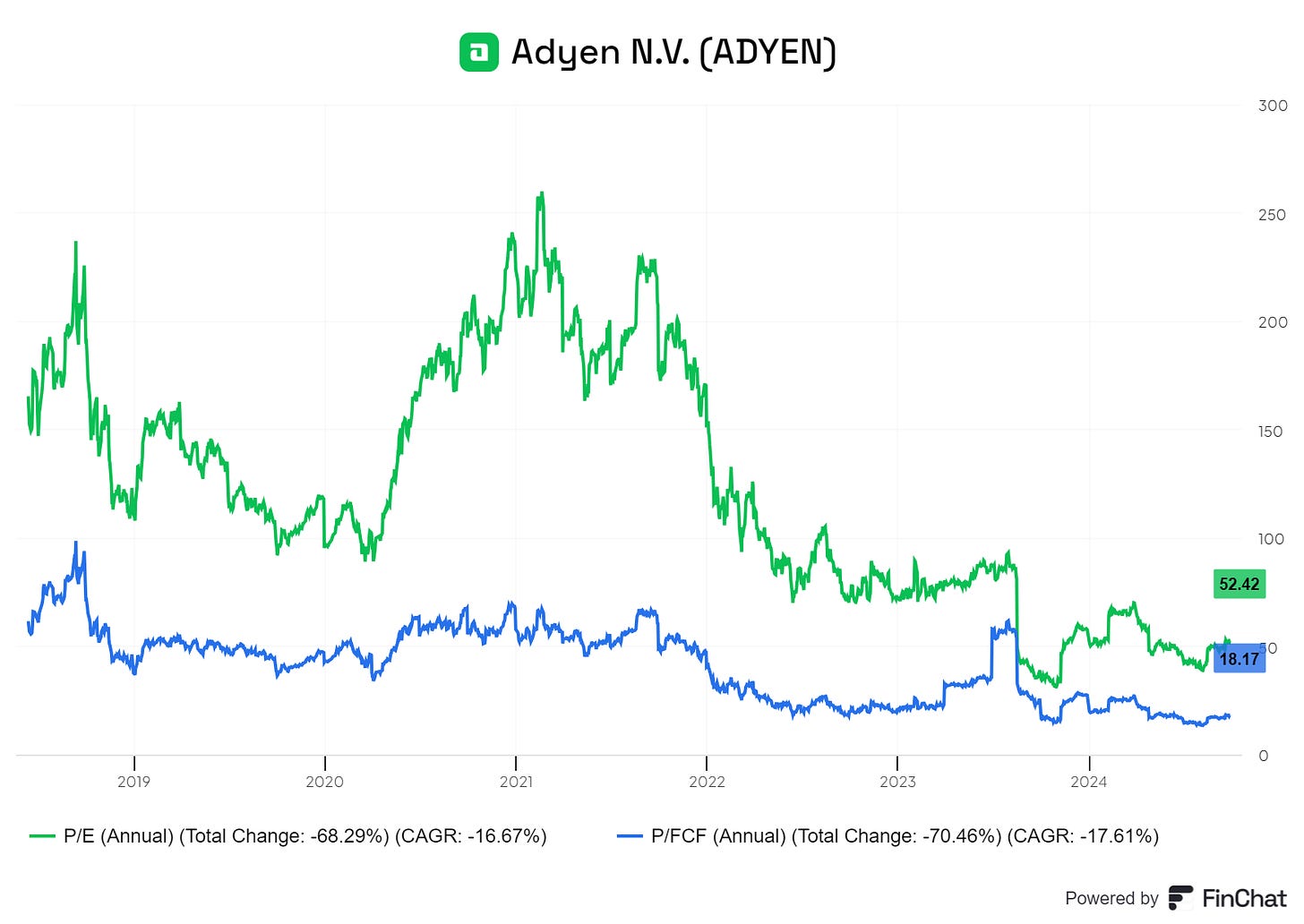

Adyen - A payment processing champion ($ADYEN)

I’m a big fan of Adyen. It’s a high-quality company, but it always looks expensive based on the P/E ratio. I believe the better ratio to use is the price to free cash flow.

I bought it at the dip last year.

Current PE = 53 / On the dip PE = 31

However

Current P/FCF = 15 / On the dip P/FCF = 17

In other words, it looks less expensive when you look at cash flows. If the P/FCF comes back down to 15, which is similar to a 6% FCF yield, I would consider adding to my position. Adyen is a long-term play.

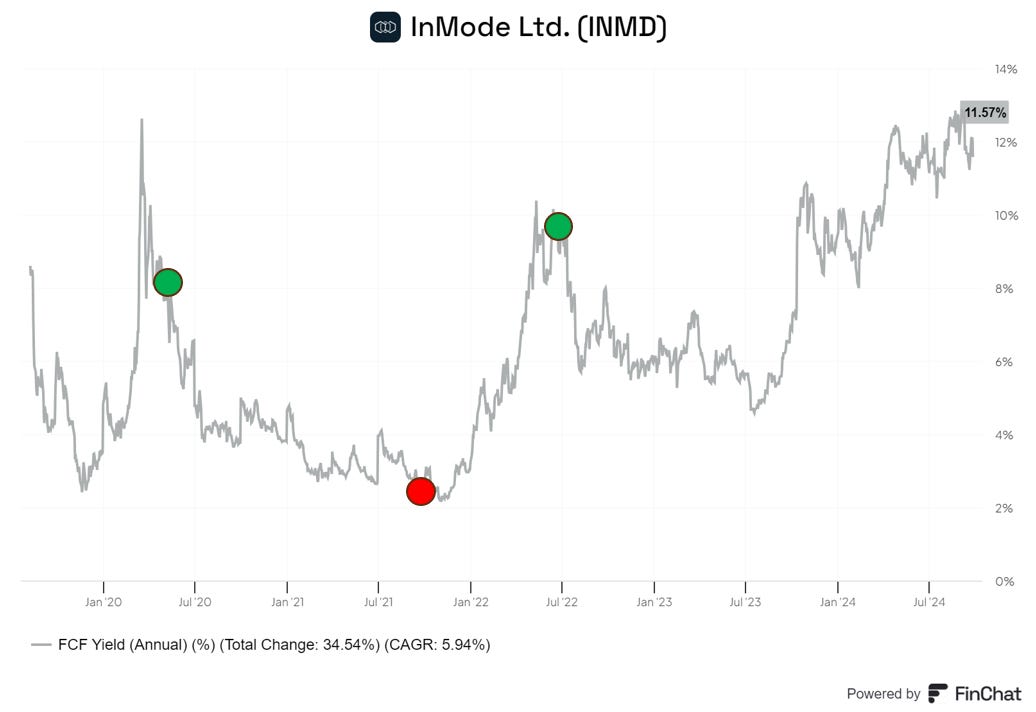

Inmode, a cash machine giving back ($INMD)

The best way to look at Inmode is:

The Free Cash Flow

The shareholder yield

Inmode is a company in a short-term decline at the moment. However, it still produces cash flows. A company with high ROIC but low reinvestment rates has to give back its cash to its shareholders. If not, there is no reason for owning it.

In the past, Inmode was very hesitant to do this. They changed their mind in 2024. After their latest 10% buyback program, they recently approved an additional buyback program for 8% of the shares.

My buys/sells are highlighted in the chart.

Will everything play out? It all depends: are the problems Inmode is facing temporary in nature or permanent. At this time, I’m giving them the benefit of the doubt.

Valuation and the football field

Any multiple you choose is a shortcut to valuation. The intrinsic value of any company is the sum of all future cash flows discounted to the present day. Even the master says it

Buffett does not do DCFs in Excel. So the best way to approach this is to use a football field approach. Using different angles of attack and laying them out next to each other.

Look at the appropriate multiple

Use a reverse DCF to think about market expectations

Use the earnings growth model to get an idea of potential returns

You can find templates in the Tools section of the website. Dive deeper by reading one of Mauboussin’s papers on valuation.

Conclusion

There is no 1 ring to rule them all. Here’s what we’ve learned:

Know the business model (s)

Understand where they sit in a life cycle

Use the appropriate multiple based on this

A multiple is a shortcut to valuation, intrinsic value is what matters

Use a football field approach from several angles: valuation is not an exact science

Have a great weekend and as always,

May the markets be with you!

Kevin

Another great post Kevin and as I have said before, you are now the only substack I follow. Unfollowed everyone else. Since you give us valuable insights I would like to add some thoughts that I believe might be useful. I am a full time investor and I need a 7% real rate of return. For mature businesses I look at EV/Sustainable Earnings as my preferred valuation measure. For example lets say I expect sustainable NOPAT margins to be 10%. My benchmark is a 7% real rate of return. If I expect the sales to grow with real GDP (and there is no point in owning a business that won't grow with real GDP atleast) thats a 1% return. I want at least another 6% so I will not pay above a 16X EV/Sustainable Nopat. Ideally not above 13X after incorporating a margin of safety. For growth businesses the logic is the same ...its just that for the 1st 10 yrs you have to forecast earnings by year so its a 10 year DCF + terminal value calculated on principles above. And for Indexes I do exactly the same but drill down to Price/Sales as Sales always grow with GDP and profit margins of broad indexes are very easy to forecast as there is a TON of economic data. I invest in India, UK and US.

The chart in there is super useful. Thanks!