Oh yes. He’s not a fan of index investing.

But let’s back it up a little. Who is Seth Klarman?

Seth Klarman is a value investor, and hedge fund manager. He is the founder and CEO of the Baupost Group, managing about 25 Billion USD in assets. He’s written the classic book “Margin of Safety” which you can still find on eBay, but it might be a tad expensive:

We’ll take a look at:

Why Seth does not like Index investing

7 lessons from Seth Klarman’s writings

Onward! ⬇️

Index Investing

Seth is a true value investor meaning:

Doing fundamental analysis

Defining the intrinsic value of a company

Only buying when the discount in price is high enough (margin of safety)

His main gripe with index investing is the complete absence of fundamental analysis.

Let’s say you buy an S&P 500 ETF.

Money flows into the ETF, which will buy the different holdings of the index it is trying to replicate based on its current relative composition.

The ETF does not care about valuation. It disregards P/E ratios or other pricing multiples.

So what? Why does Seth think this is a problem?

His reasoning is the following:

The more and more people who Index, the more inefficiencies will arise in the market as most people do not care about valuation

If everyone were to index, who would move the price of a stock?

Or as Barron’s has stated:

“A self-reinforcing feedback loop has been created, where the success of indexing has bolstered the performance of the index itself, which, in turn, promotes more indexing."

When the market trend reverses, matching the market will not seem so attractive, the selling will then adversely affect the performance of the indexers and further exacerbate the rush for the exits.

Just to give you an idea: 60% of Nvidia shares are owned by institutional investors and probably half of that are passive funds. Not to diminish the AI wave Nvidia is surfing, part of the high valuation can be attributed to the index blindly buying the company.

Passive vs active: The numbers

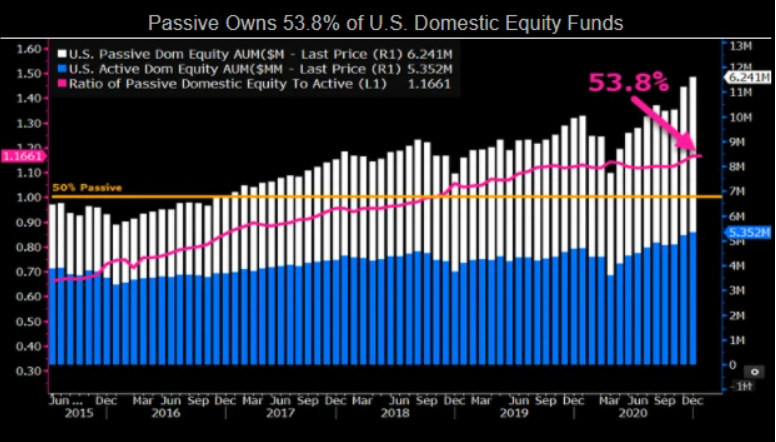

In 2018, in the equity asset class, in the US, passive funds had already overtaken active ones:

https://www.bloomberg.com/professional/insights/trading/passive-likely-overtakes-active-by-2026-earlier-if-bear-market/

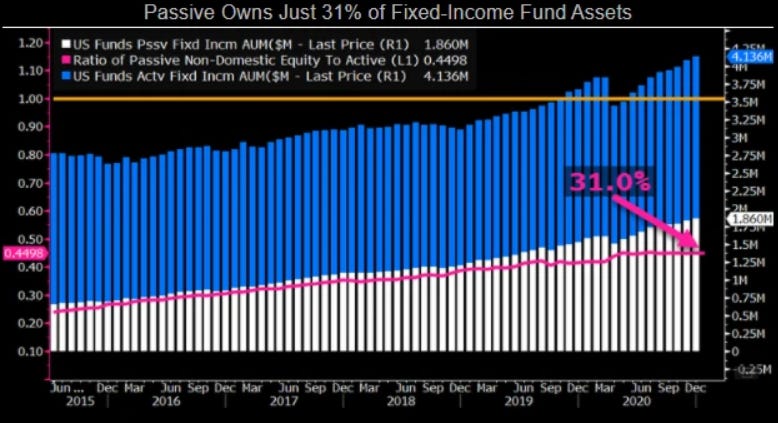

The situation in the bond market is a bit different, where active management still has a lead on passive:

My take

I do not believe in a doomsday scenario where index investing will eventually implode the market. There will always be people who will search for that edge, the alpha. It is in our nature. And when the next bear market occurs, we’ll see how people will handle it.

It can however partially explain why some large-cap companies have lofty valuations. Can the high Shiller PE be explained partially by the rise in index investing?

If you don’t care about individual companies, indexing is still a great way to get exposure to an asset class like equities. Does that mean you need to put everything into the S&P500 index like Warren Buffett proposed to get a 7-8% return over the coming decades? Spreading over different less correlated asset classes is always a good idea.

What do you think?

The 5 Insights of Seth Klarman

When it comes to picking individual stocks, Seth has some great lessons. Here are the best ones.

Consistent returns > volatile returns

Never stop the compounding process. A one-off large loss can have a significant impact on your final return. You’ll likely do well if you can have more modest but consistent returns as opposed to wild swings every year.

I understand what Seth is saying. He is focused on risk and aims for more steady returns at a lower risk. I do not mind the swings. you cannot expect steady returns when part of your investing strategy is to invest in microcaps.

Process > Outcome

How you get to a certain outcome and having a solid process is more important than the actual outcome or goal you want to achieve. Seth refers here to the, take care of the downside and the upside will take care of itself.

I do think it’s important to have both, a process and a desired outcome. My hurdle rate is simple, a high probability of doubling in 5 years (15%/year return). Setting a hurdle rate makes it easier to say no to all the ideas.

Why a margin of safety

We discussed the margin of safety in the introduction. But why is it so important?

Nothing in investing is precise. Valuation is not precise. Hundreds of variables influence the outcome. Luck plays a significant role. We need to make sure when taking a position, that most of the downside risk is eliminated.

We are human, we make mistakes. If your margin is big, and your thesis is wrong, you might be able to limit your losses.

How much margin of safety?

How much is enough?

How much volatility can you absorb?

What is your tolerance for error?

How much can you afford to lose?

The question of “how much” should be considered as a ballpark number. If valuation is a range and not a precise number, buying a stock for 50% of the lowest value in your valuation range might be a good enough margin of safety.

This remains the (h)art(d) part of investing.

The 3 elements of value investing

Bottom-up approach: Analyze each company individually from the ground up

Absolute performance: Do not try to beat a benchmark. Do not try to beat other investors. Set your own goal that you want to achieve. I know investors that aim for 10% and are happy to achieve that. Great! We already live in a world of endless comparisons and social competition. Aim for your goals.

Risk: This is where a lot of investors fumble. They quickly look at the upside potential. Investing more time in the downside. What are the risks for the company? Where can it go wrong? Do you feel comfortable with it?

Summary

I think there are some valuable lessons we can learn from Seth Klarman. The end goal should be to devise your own investing strategy, taking ideas from the greats and applying them in the markets.

May the markets be with you, always!

Kevin

Worth noting that modern factor-based ETFs actually blend the best of both worlds - they maintain the low-cost efficiency of index funds while incorporating fundamental analysis through value, quality and momentum screens, potentially addressing some of his key concerns about blind price-agnostic buying.

There are other problems with index funds. Since index funds are passive, they generally do not participate in active shareholder actions. They are very likely to vote with the management on issues requiring shareholder votes, including on the question of executive compensation. It is also very likely that in most larger companies, index funds control majority of the votes. It is easy to see how management's accountability to the shareholders is materially diminished as index funds have grown.