A long time ago, in a country not that far away, I bought my first car.

A Volkswagen Golf.

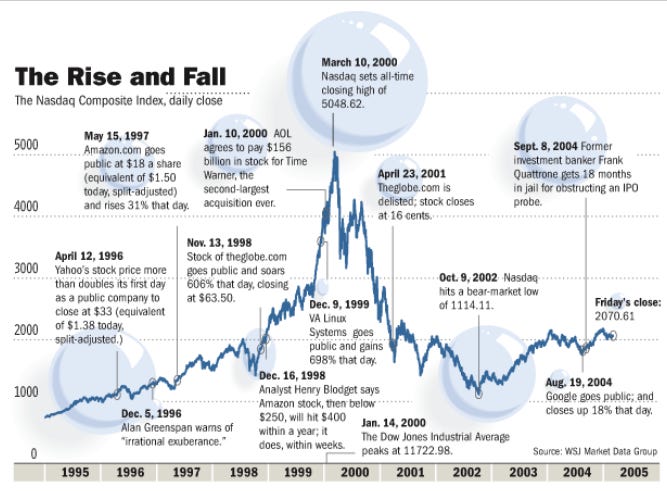

It’s the year 2001. I wasn’t even aware of the stock market back then, let alone the existence of a dot-com bubble.1

My parents were worried.

“A cell phone AND a car!” This is going to be a disaster. You need something to drive hands-free.

Hands-free, in a car, with my phone? That doesn’t exist.

But it did.

It looked like this:

It’s weird how life works.

25 years later, I’m going through that same company’s annual reports.

Some stats:

74% gross margins

Just turned profitable

115% revenue growth in the drone segment

Recently pivoted its business model from B2C to B2B

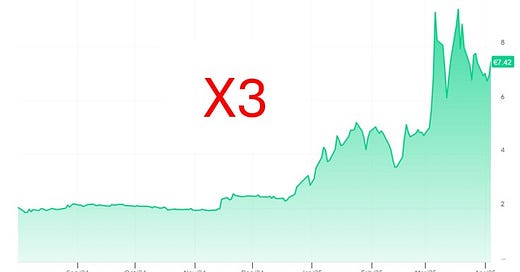

Riding a huge wave in the defense sector (almost a triple in 1 year)

The question is simple. Are we too late, or is there still room for more upside?

Let’s dive in ⬇️

Introduction

Parrot SA is a French drone manufacturer (190M EUR Market Cap). It no longer builds those Bluetooth car kits I used in the 2000s. In 2010, it pivoted to focus solely on drones. Due to increased competition from the Chinese market leader DJI, in 2017, it pivoted once again by exiting the B2C market and entering the B2B market.

Smart move.

I can already say I like that a company keeps pivoting. It means management has a good view of what works and what doesn’t, and is not afraid to change business operations.

You can imagine what happened next.

The wars, geopolitical shifts, Europe that aims to arm itself. Legacy defense changing towards new innovative solutions.

Parrot and others stand to benefit.

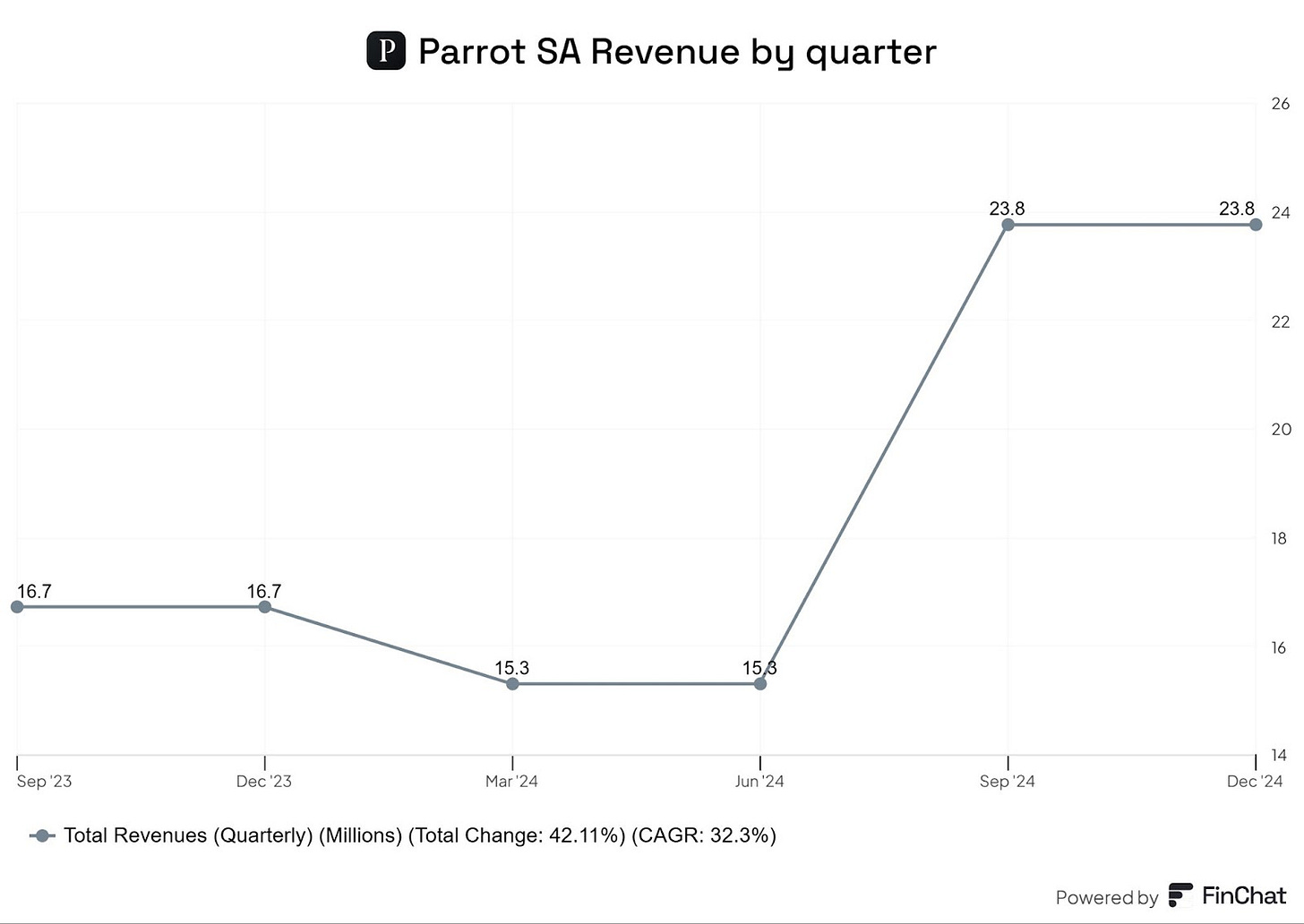

Then this happens during the last half year in 2024:

Suddenly, the company reached profitability. As you can imagine, the stock price followed:

I was not exaggerating when I chose the word Kaboom in the title.

There are several questions we need to answer:

How does it make money?

Is the market actually heating up?

If growth continues, how much is already priced in?

Let’s go ⬇️

How does it make money?

Parrot generates revenue in 2 ways:

Hardware Sales: The company designs and manufactures professional-grade micro-drones like the ANAFI series, which are tailored for industries such as defense, agriculture, and infrastructure inspection.

Software Solutions: Parrot’s subsidiary Pix4D provides photogrammetry software that converts aerial imagery into 3D maps and actionable data. This software-as-a-service (SaaS) model caters to sectors requiring precision analytics, such as construction, mining, and precision agriculture.

Photo what?

Photogrammetry: You use images from different angles to create 3D representations of objects and environments. You need specialized software to ‘stitch’ these photos together.Well, that was easier than I thought. 😉

This is one of the reasons that got me interested in the company. I don’t like investing in a pure hardware player. You know what Professor Bruce Greenwald says on competitive advantages for hardware:

“In the long run, everything is a toaster.”

As was mentioned in the introduction, their customer base now includes governments and enterprises. They have exited the B2C market.

This video will explain how their Anafi USA drone works.

You’ll see that the review talks about Blue UAS and that this drone is on that list. "Blue UAS" refers to a U.S. Department of Defense program that identifies and approves commercial drones for government use.

One of the things Parrot did to get this certification is move their production from China to South Korea, and for specific US drones, they are built in the US.

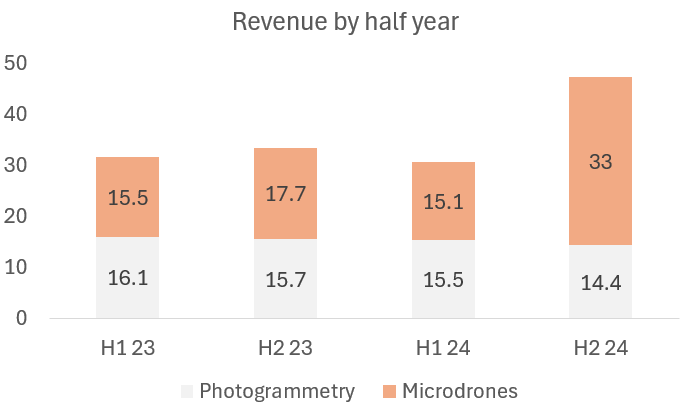

Now, let’s see how revenues have evolved for the hardware and software part of this business.

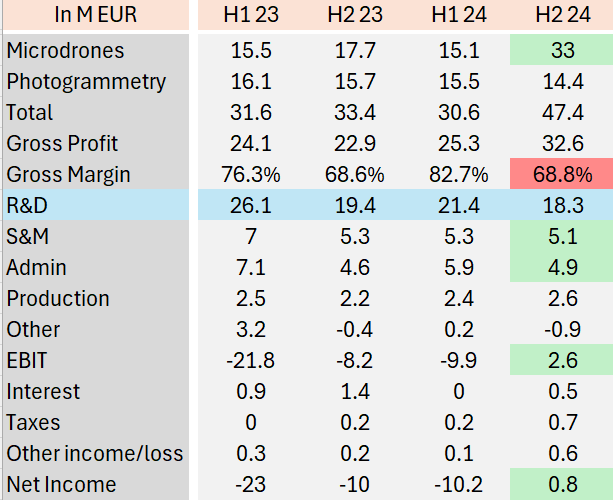

The software revenue side decreased while the drone revenue doubled compared to H1 2024.

It’s great that they managed to grow that fast, but gross margins did fall from 82% to 69%, meaning their software business provides better margins. Overall, margins remain high. Will their software part grow in a delayed fashion to their hardware sales? I don’t have the answer to that at this time.

Profitability

So its drone department is growing fast. But what about profitability? Their recent revenue increase made them profitable. But there’s something strange going on when you look at the income statement ⬇️

All their R&D costs are expensed. You won’t find them on the cash flow statement.

This reminds me of a previous company we covered that does the same thing.

Although this means your earnings closely resemble your cash flow, it does pressure profitability compared to other companies.

They slightly reduced costs in Sales and Admin to increase operating income the last half year.

Parrot does not have its own factories unlike some competitors do. They outsource production in South-Korea or to their partner in the US called Neotech.

Cash flows

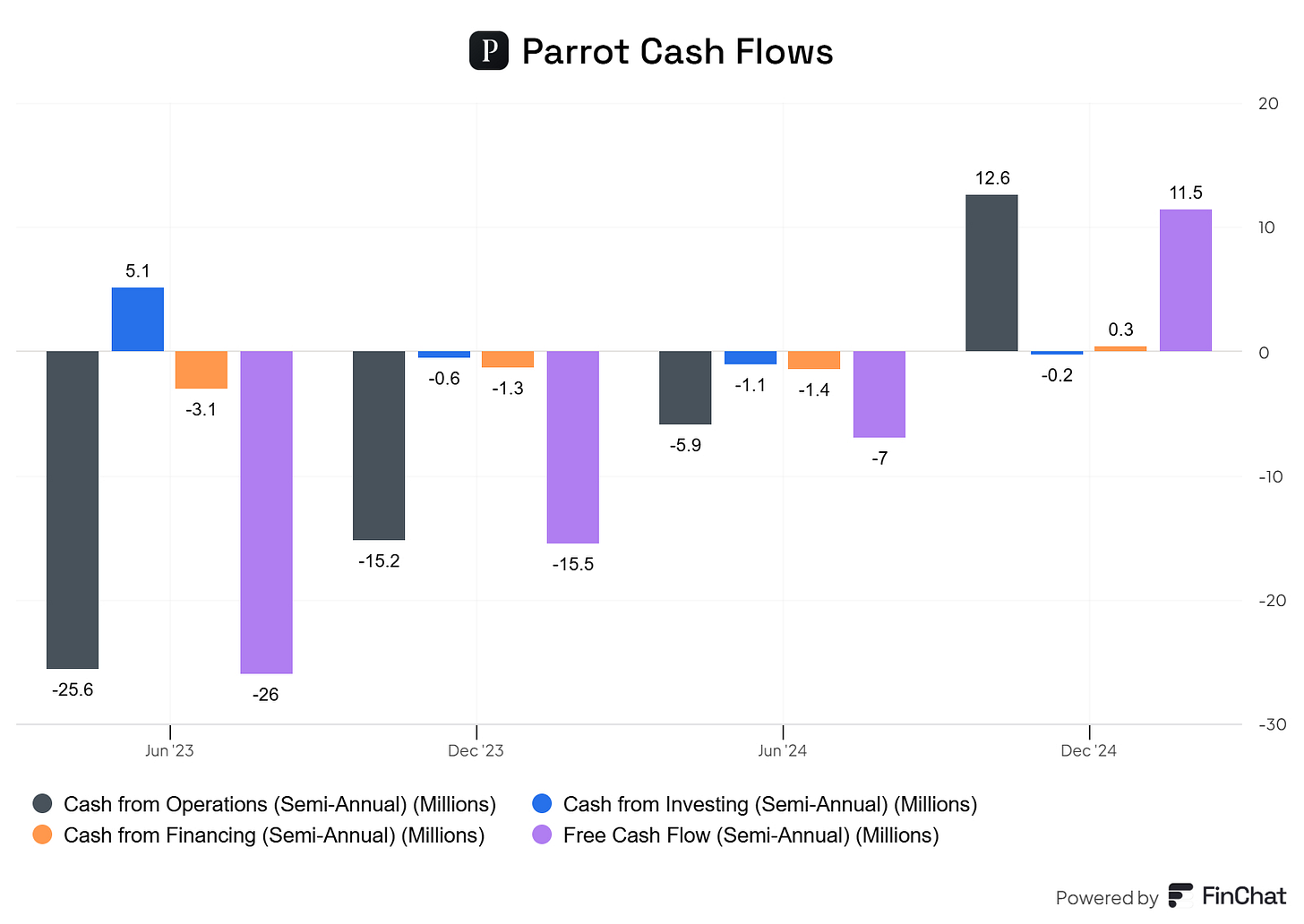

This is the trajectory you would want to see in a fast-growing company:

Cash flow from operations increasing

Asset-light, so no D&A

No debt

And since mosts costs are expensed, Operational cash flow drops down immediately to free cash flow.

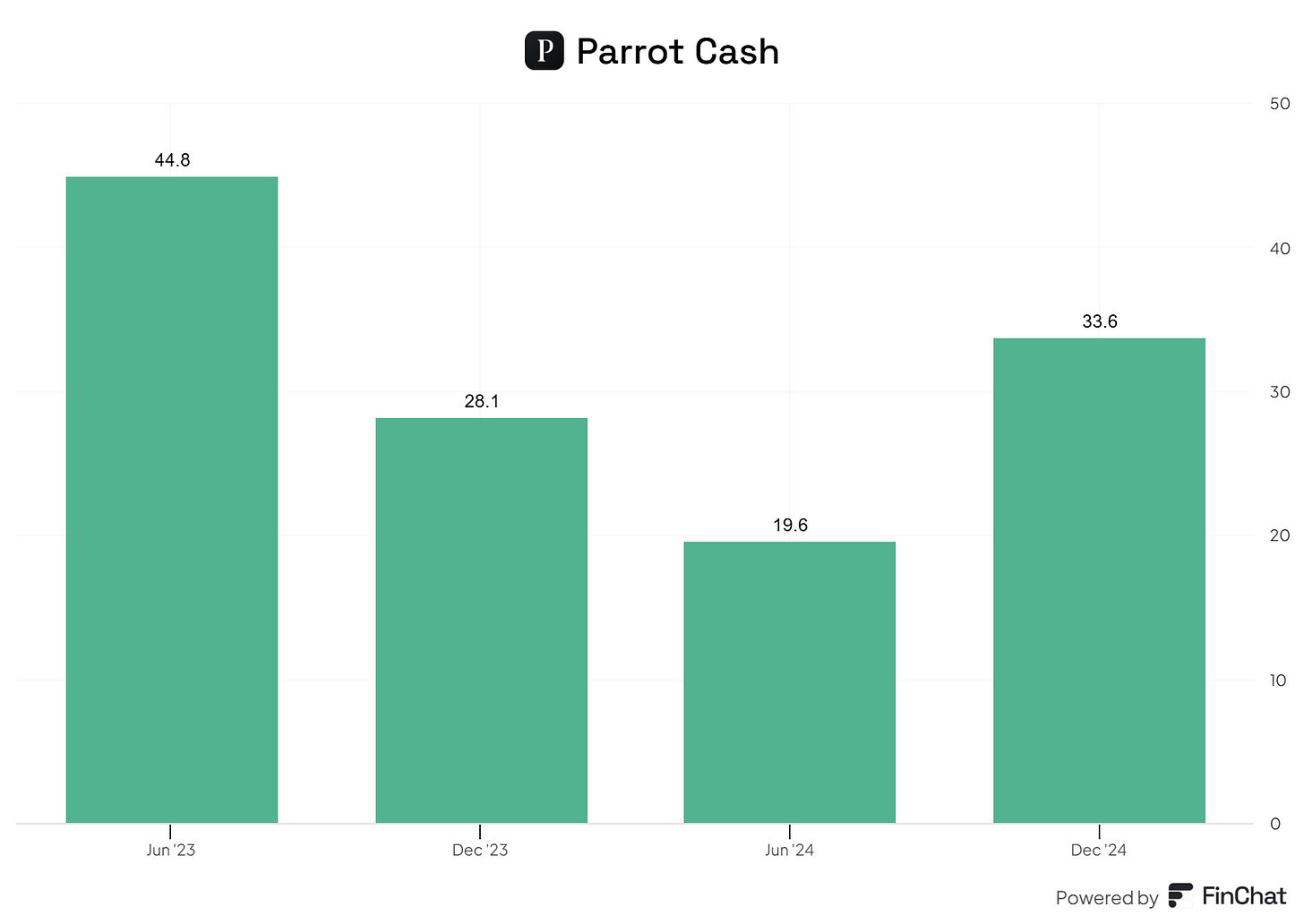

The company was in cash-burn mode until the sudden revenue growth.

Riding a wave

Let’s go deeper to see what is driving this growth and see if it can be sustained into the future?

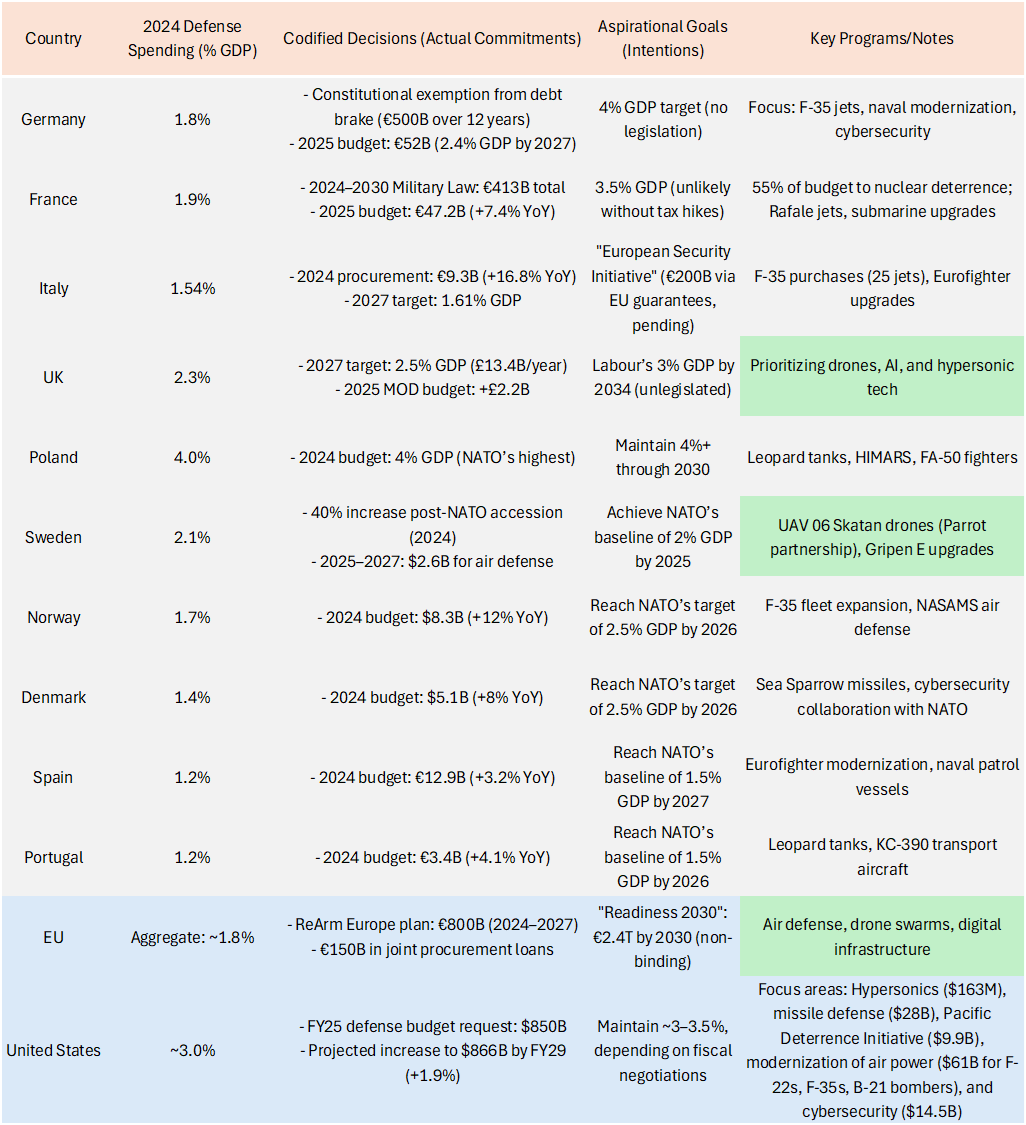

As you can imagine, a wave in defense spending is rising and has started to flow. How big the wave is and how long it will last is difficult to say.

You can consult the table below to get an idea about the future defense spending in Europe and the US. I highlighted in green when there is talk of drones.

Here’s what we know:

Parrot SA has a contract with Sweden. They will have to deliver the Anafi USA drone, which has been renamed UAV 06 Skatan. The size of this contract is unknown, the deal involves deploying these drones to enhance tactical operations such as surveillance, protection, and defense tasks at platoon and group levels.2

Lithuania signed a €36 million ($40.2 million) contract with Parrot for Anafi tactical microdrones as part of its unmanned aerial systems expansion project. The first tranche, valued at €2.5 million ($2.7 million), has already been delivered, with additional systems expected in 2025 (this means 33 million euros has not been recognized yet and is planned somewhere in the future).3

Several discussions are ongoing in the US. A budget is being developed of 25M USD for 2025 to purchase 1700 cheaper drones like the Parrot Anafi. This doesn’t mean the entire budget will go to the Parrot, of course. (The article does mention that DJI remains the leader in the field, but since it’s a Chinese company…)

On a less specific and more general note, Parrot is reportedly in discussions with NATO states for supplying drones capable of operating in Arctic conditions. These efforts align with NATO’s push for innovative solutions from smaller manufacturers to address extreme weather challenges.4

We can end this section by adding these 2 topics:

For the entire EU, one of the focus points is the use of drone swarms. This is not within the capabilities of Parrot. Anduril is a private company that specializes in swarms.

The UK is also prioritizing drones, but no detailed information exists

Conclusion: Parrot (and other drone companies) have a tailwind. We know that 33 million EUROS have not been recognized yet in their revenue. And a potential part of 25 Million USD could be captured in the future from a new US budgeting program. Other deals or contracts are likely, but there is no information available on the value of these.

Now let’s go to the valuation and conclusion ⬇️