I swore it.

I swore to myself to never look at a pharmaceutical company ever again.

I went to business school about 10 years ago and met a guy who worked at Argenx (Ticker: ARGX).

Me: “Hey, what does your company do?”

The guy: “Oh, we're in biotech. Pretty cutting-edge stuff.”

Me: “Nah, Biotech. I got burnt on that stuff. Outside of my circle”

➡️You can probably guess what Argenx did next…

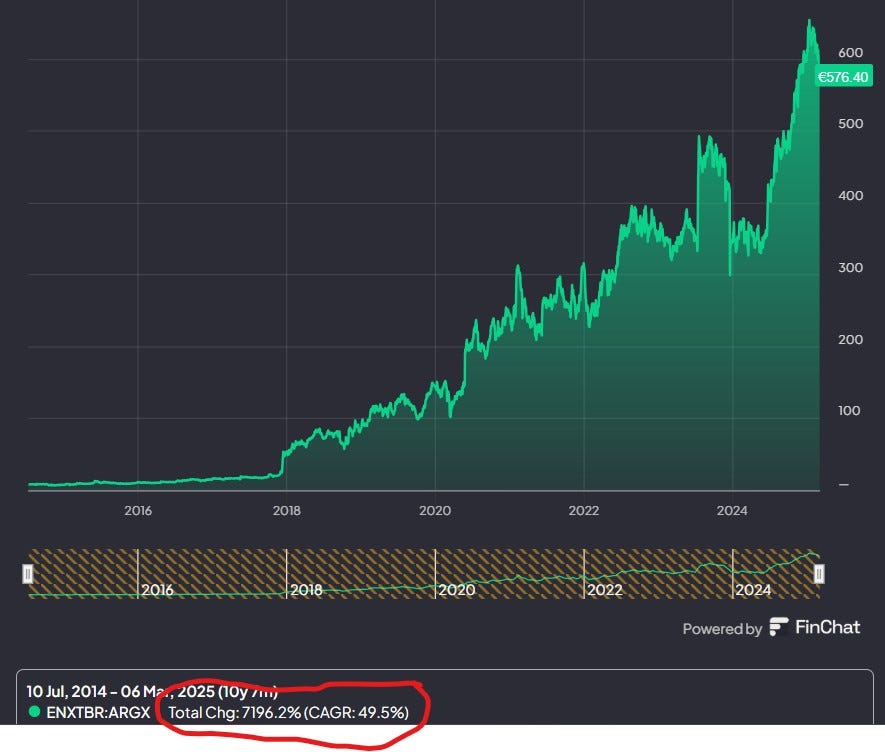

Let me just rephrase this picture:

A 7000+% return in 10 years

That’s a 50% CAGR

Or a 70-bagger

All the losses I have ever endured pale in comparison to this opportunity cost.

I wonder if he still holds his shares. I’m going to reach out to him 😉

And then this week, I tweeted this:

I made the mistake of setting limits in the past. Hard rules are bad. Dogma is worse. We must follow our curiosity, see where it leads us, and go beyond self-imposed boundaries.

And for an imperceivable reason, I’m drawn to this pharma company.

Maybe it’s because they use a hurdle rate for their investments

Maybe it’s because the CEO lives in the town where I was born

Maybe it’s because he has a great track record with several successful exits

I don’t know.

This is the first article, aimed at diving back into the pharma industry. I've read the annual reports. I've read the press releases. I talked to some analysts at some banks. And I hope that I can give you some insight. I go where my curiosity and my gut lead me.

Let’s dive into the wonderful world of repurposing existing medicines. ⬇️

Note: Just before publishing this article, by coincidence, the company published a press release with positive developments for one of their molecules. The stock jumped +15% on the news. After reviewing it, it doesn’t change the below discussion.

Introduction

Hyloris ($HYL) is a Belgian microcap with a market cap of €140M in the repurposing medicine branch of the pharma industry. It generated its first revenue in 2024 but is still unprofitable.

Here’s how they pitch themselves:

Hyloris Pharmaceuticals is a specialty biopharma company focused on reinventing and optimizing existing medications to address unmet medical needs. We leverage established regulatory pathways, like the FDA’s 505(b)(2), to reduce development timelines, costs, and risks. Our portfolio includes 19 reformulated and repurposed medicines, with two already in early commercialization: Sotalol IV for atrial fibrillation and Maxigesic® IV for postoperative pain. We aim to expand to 30 products by 2025, delivering high-yield, patient-centric solutions that improve therapy outcomes and create value for patients, healthcare professionals, and shareholders. With a lean and efficient operating model, we’re committed to becoming a leader in value-added medicines.

It’s a great pitch. This pitch always resurfaces when I read other articles or releases on this company. It’s powerful.

But how plausible is it?

Let’s back it up a little, and first look at how a drug is made. You can skip this part if needed.

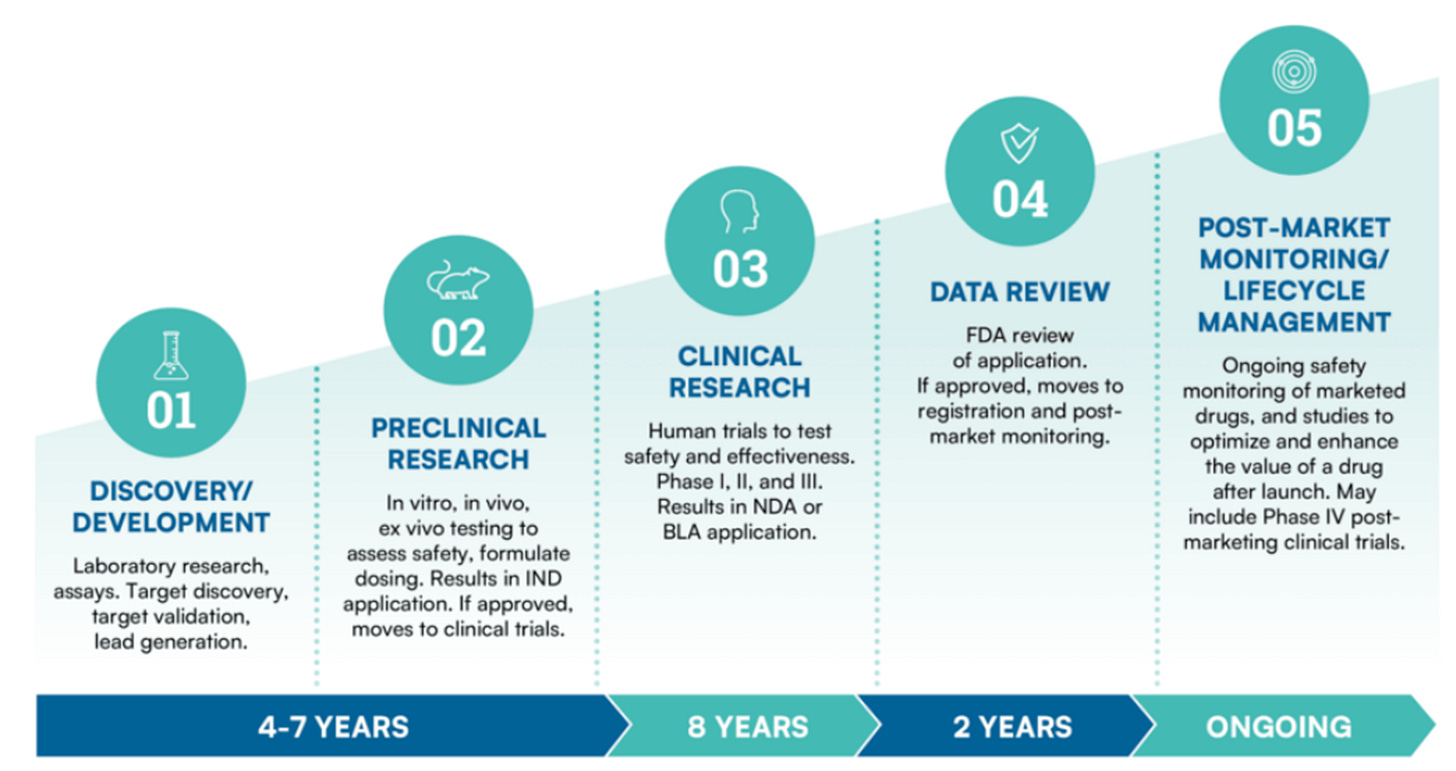

Start Intermezzo: How does a drug get made?There are 5 steps when it comes to drug development:

Step 1: Discovery and development: You look for a target (disease to cure or symptom to alleviate) and you design a drug

Step 2: Pré-clinical research: You’ve got your drug candidate, but do the benefits outweigh the cost? Testing on safety and toxicity, usually on animals

Step 3: Clinical Research: It’s time to see how humans respond to the drug. Gradually, more and more people will be tested (if the results are positive in each step. Typically, this step is divided into 4 phases:

Phase 0: Preliminary testing on 10-15 patients to hone in on the compound selection

Phase 1 trials: Assess safety, dosage range, and side effects in humans to up to 100 patients

Phase 2 trials: Evaluate the efficacy and further assess the safety of up to 300 patients

Phase 3 trials: Confirm effectiveness, compare to existing treatments, and monitor long-term safety of up to 3000 patients

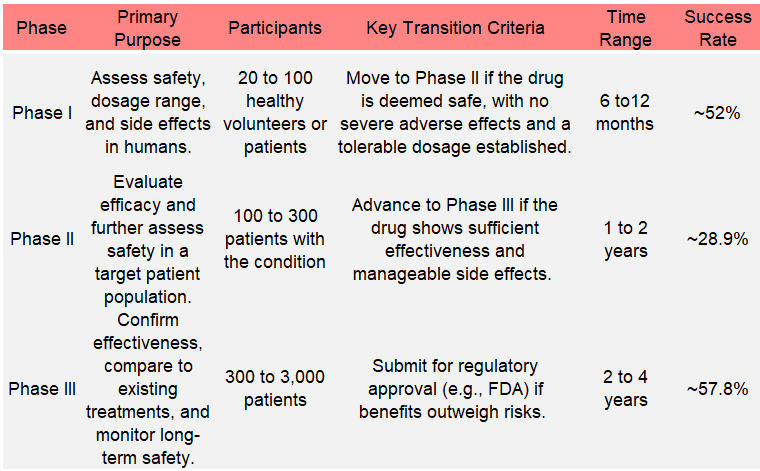

The table shows the 3 phases with the typical time it takes and the average success rates:

This means that about 8.7% of drugs that start clinical trials will succeed in all 3 phases. Let’s proceed to the last 2 steps.

Step 4: FDA Approval allowing the drug to be sold to the general public. 90% of drug applications are approved in this stage. This lowers your 8.7% to 7.8%

Step 5: Once your drug is distributed, monitoring and life cycle management is done to see if everything is safe

What we’ve learned is this:

From nothing to selling a drug in the population takes between 13 to 17 years

The probability of getting that drug into the market is low (<7.8%)

It typically costs about 1 Billion USD if you include all the capital costs and the many failures

This means, that because these companies are tackling hard problems, there are natural barriers to entry in this market. Those that succeed in the market, do well and are generally highly profitable.

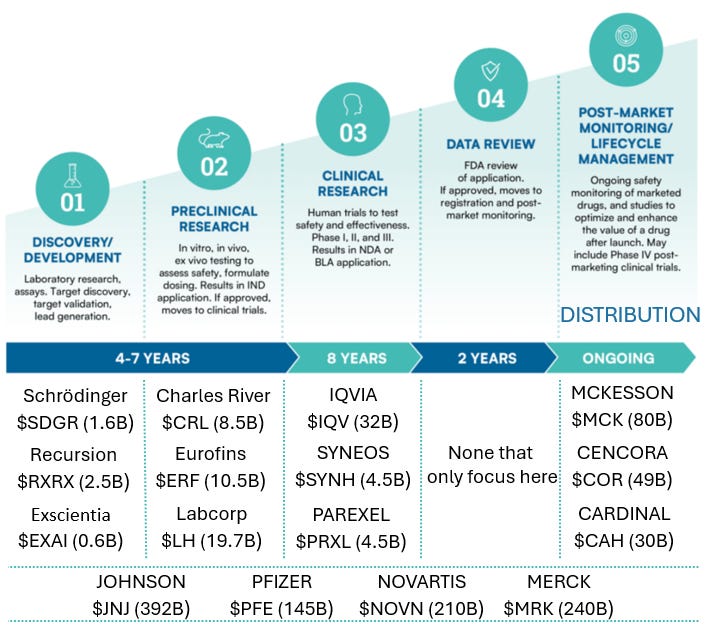

To provide some examples of companies, here’s the above info chart but with examples of companies and their tickers and market cap (in USD)

A company on my watchlist, Medpace ($MEDP) is a contract research organization that provides services to other pharmaceutical companies. It covers phases 1 to 4.

The End of the IntermezzoWhy is the repurposing market different?

Hyloris is a player in the repurposing drug market. This means they look for existing drugs and try to do 2 things:

Find existing drugs that can be used to cure or aid other diseases/ailments

Find novel applications to administer existing drugs: Example: A drug that exists as a pill, develops into an aerosol that works faster

You can already guess what this means. Because the goal is to repurpose drugs, the above phases still hold, but they are faster and less costly.

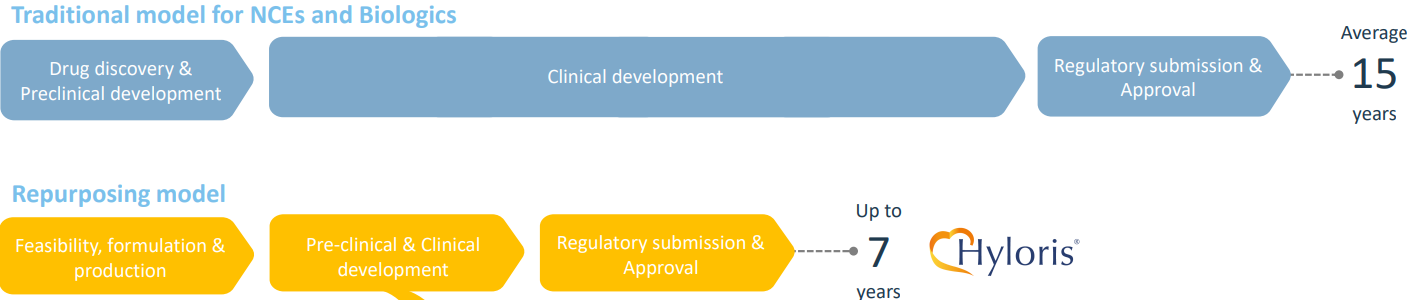

Here’s a comparison from Hyloris’ investor presentation:

Roughly speaking, you cut the above-mentioned development cycle in half.

The numbers for the overall global pharmaceutical markets and the drug repurposing market:

Pharma is a 1.7 Trillion USD market set to grow to 2.4 Trillion in 2029 (CAGR 6.3%)

The repurposing pharma is a 32 Billion USD market set to grow to 52 Billion in 2033 (CAGR 4.5%)

The repurposing market is only 1.8% of the current total pharmaceutical market.

So if we go back to the pharmaceutical value chain Hyloris operates in the first 4 steps, from product reformulation to clinical trials and filing NDA’s (New Drug Application) for FDA approval. We know they partner up with other pharma companies. The last step, commercialization is outsourced to other companies.

How does the company make money?

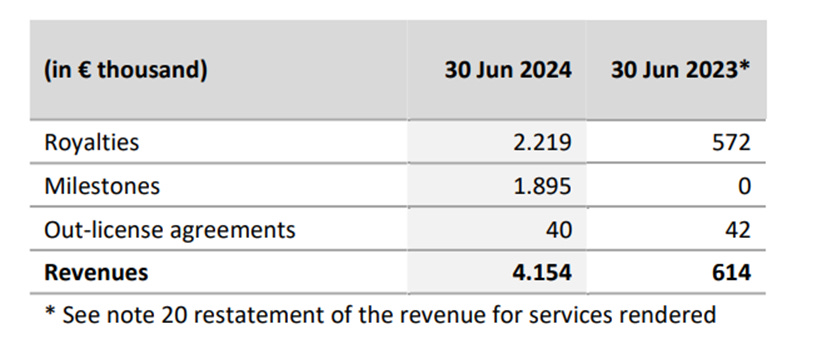

There’s a lot of little things going on at Hyloris, but their base business model looks like this (from their H1 2024 earnings report)

Revenue is generated in 3 ways:

Royalties received based on sales. Hyloris partners up with other pharmaceutical companies. Then they license their IP for sales and distribution. A royalty will be received as a percentage of sales.

Milestone payments are one-time payments based on certain thresholds met in the development process. There are on-offs, but they allow the development process to be de-risked.

Out-license agreements are specific revenue generated through IP contracts.

Beware that this also goes the other way. Hyloris also signs contracts with other pharmaceutical companies where Hyloris has to do milestone payments and royalties once a drug is sold to the public.

I mention that a lot is going on because Hyloris also holds stakes, or has provided loans to other pharmaceutical companies.

An equity investment in Pleco Therapeutics (1M euro in the balance sheet)

An equity investment in Vaneltix (2 M euros)

20% stake in Purna Female Healthcare (PFH) with an agreement to recoup between 17% and 45% of profits in the future

A loan to Applied Pharmaceutical Innovation (API) of 200k

So to summarize: They are making a lot of small bets using a hurdle rate, hoping some of them take off.

I’m guessing this will make it harder to do a forecast for future revenue and EBIT because we’ll need to sum up all the bets.

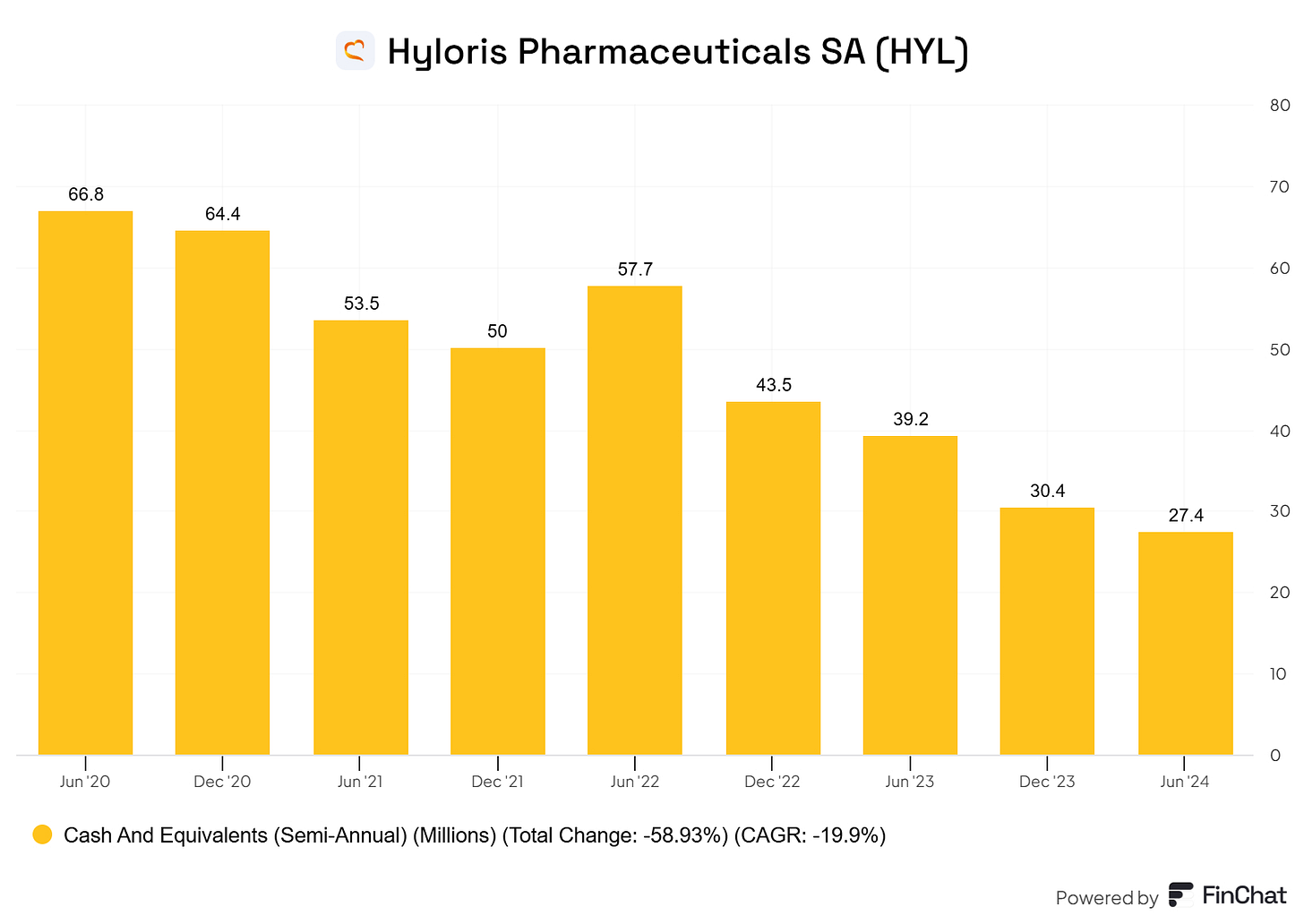

So they need cash to upfront the development and clinical trials which they claim never exceeds €7 Million per drug. This explains why at the moment, they are still in cash-burn mode and are unprofitable ⬇️

They currently have 21 molecules in their pipeline and aim to have about 30 at the end of 2025. Only 3 of them are being sold in different markets today.

Who are the other players in this market?

Hyloris is not alone in this subsegment of the pharmaceutical market. Here are some other players:

Recursion Pharmaceuticals (Ticker: RXRX) is one of the leading innovators in the drug repurposing field. They use data science and AI algorithms to find novel drugs for other diseases. They have about 30 candidates in their pipeline

Melior Discovery specializes in drug repositioning through its proprietary phenotypic screening platform. It allows the company to identify new therapeutic indications for existing drugs by observing their effects across various biological models.

United Therapeutics (Ticker UTHR) has an almost identical business model to Hyloris focusing on unmet medical needs. Its focus is on chronic and life-threatening diseases. It’s a 50-bagger since 1999 (17% CAGR). Is this a glimpse into Hyloris’ future?

Other companies in this market are SOM Innovation Biotech and Vertex Pharmaceuticals. In particular, here are some companies that specifically use AI for the repurposing market:

Ginkgo Bioworks: Utilizes artificial intelligence platforms and synthetic biology to engineer enzymes, proteins, and drug molecules for repurposing efforts

Atomwise, Inc.: Employs AI-driven approaches to drug discovery and repurposing, specifically using structure-based methods to identify new applications for existing drugs

Biovista, Inc.: Focuses on systematic drug repurposing using their proprietary platform to identify novel uses for existing drugs across multiple disease areas

NuMedii, Inc.: Leverages big data and AI technologies to discover new uses for existing drugs through their proprietary technology platform

Exscientia Limited: Pioneers AI-driven drug discovery methods that can be applied to repurposing existing compounds for new indications

Does this mean, it’s like a giant eating a loaf of bread and crumbs falling on the ground where Hyloris and the others gobble them up?

Oh no, the giants also eat the crumbs ⬇️

Pfizer, Johnson and Johnson, Sanofi, GlaxoSmithKline, and all the others try to repurpose their licensed molecules.

The summary:

It’s a very competitive market

The competitive advantage is based on IP/patents which are limited in time

What will the impact of rapidly developing AI models be on this market and in particular on Hyloris?

Let’s go to a preliminary valuation and conclusion